Digitalization in the Travel Industry

Leisure brands are struggling to get customers back following the pandemic

Despite consumers’ lack of travel experiences over the last year, the majority do not feel inclined to take a vacation even one year from now.

The main reason is wanting to avoid ‘in-person activities’ (Mintel). In a study, they listed the leisure activities that cause them most concern as:

- watching events in person

- taking a flight or train

- going to the gym or cinema

Stability for most leisure brands isn’t expected until after 2021

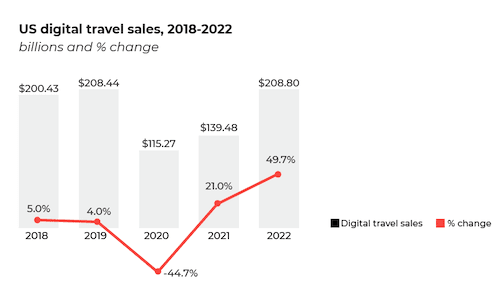

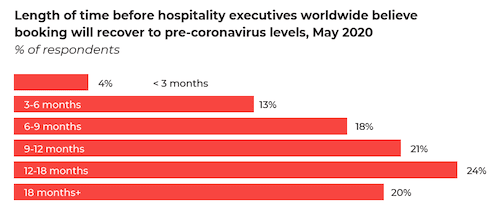

Lockdown might be lifting, but there’s a long road ahead. Nearly half of hospitality executives feel that recovery of bookings won’t be felt until after 2021, with online travel sales expected to reach 2019 levels only by the end of 2022.

In addition, global recovery in aviation sector is not expected until 2024. It’s predicted that the recovery will be led by Asia–Pacific, which could recover in 2023. Travel within North America and Europe might reach pre-crisis levels the following year.

The digital gap widens

Despite many leisure brands providing online experiences as an interim solution, omnichannel leisure has weak uptake:

36% of travel and leisure execs report gaps in the digital experience.

Less than half of travel executives feel their website, app and social channels offer great customer experience – the lowest satisfaction among all industries.

With digital ad spend taking time to recover…

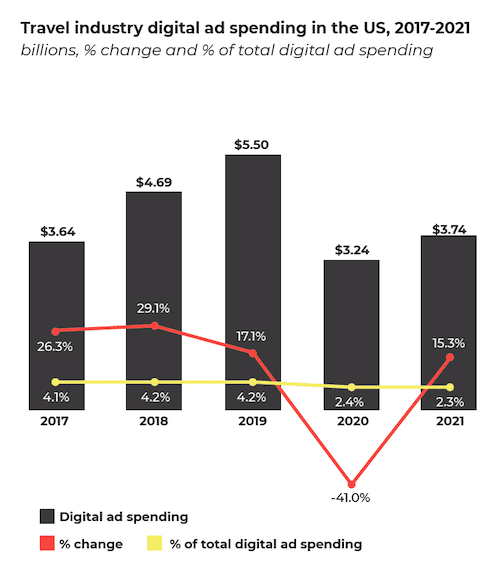

Digital ad spending in the travel industry declined by 41% in 2020. This year, it is expected to grow 15%, but won’t reach previous levels of confidence.

Opportunities to accelerate during an economic downturn

There are many creative ways that the travel industry can kick-start its recovery:

- Create more localised leisure experiences where people feel reassured that their safety is priority

- Turn offices into leisure destinations

- Use this time to focus on your online customer; improve digital capability in-house and become more responsive to the customer journey